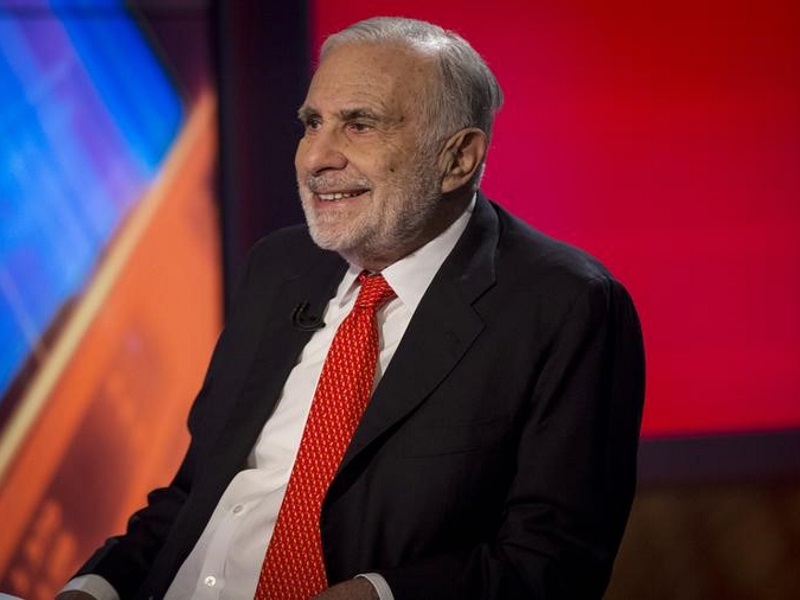

Xerox Corp said it would split into two companies, one holding its legacy hardware operations and the other its business process outsourcing unit, in which activist investor Carl Icahn will get three board seats.

Icahn, who first revealed a stake in Xerox in November, had said he would seek representation on the company’s board as well as pursue strategic alternatives. He later raised his stake to 8.13 percent.

Xerox shares rose 4.6 percent to $9.65 (roughly Rs. 655) in premarket trading on Friday.

The company, whose shares had fallen more than 30 percent in the past 12 months, has been trying to turn itself around by focusing on software and services as businesses cut costs and a switch to mobile devices hits demand for printers.

Larger rival Hewlett Packard Enterprise Co also split its computer and printer businesses from its faster-growing corporate hardware and services operations last year to adjust to the post-PC computing era.

Icahn has had considerable success with pushing companies to spin off their fast-growing businesses.

While eBay Inc split its payments business Paypal Holdings Inc, Manitowoc Co Inc separated its crane manufacturing business from its food service business.

Xerox said the separation would create a $11 billion (roughly Rs. 74,633 crores) document technology company and $7 billion (roughly Rs. 47,493 crores) business process outsourcing company.

© Thomson Reuters 2016

[“Source-Gadgets”]