digital payments firm Paytm expects to begin its bills financial institution operation in the usa with the aid of August.

The Noida-centered agency had obtained an in-precept approval from RBI to installation a paymentsfinancial institution in August final yr.

bills bank can receive call for deposits and savings bank deposits from individuals and small agencies,as much as a most of Rs. 1 lakh consistent with account.

“we are hoping to complete all of the requirements and hand them to RBI for their go–beforehand by way of August… through then, we will also have a brick and mortar set-up in vicinity,” Paytm co-founder and CEO Vijay Shekhar Sharma advised newshounds in New Delhi.

however, the focal point will be on using technology and connecting the unbanked and underbankedpopulation, he delivered.

“we can start with north east and primary as we referred to at some point of the licence system,” he said.

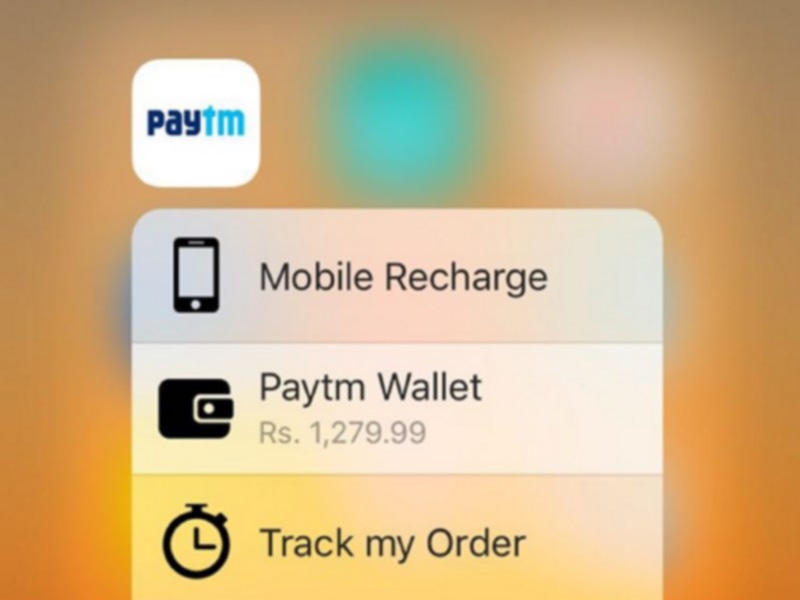

put up the launch of the financial institution, Paytm becomes an give up-to-give up payment monetaryservices company with banking and cellular pockets services. It also has an e-commerce platform as well as helps virtual fee of recharge and utility bill price.

“one of the matters we’re doing is introducing playing cards with QR codes, as a way to enable users with out smartphones to transact,” Sharma stated.

according to reports, Paytm has partnered Wipro to create the needful generation infrastructure for thepayments financial institution commercial enterprise.

Disclosure: Paytm founder Vijay Shekhar Sharma’s One97 is an investor in gadgets 360.

download the gadgets 360 app for Android and iOS to stay updated with the modern tech news, productcritiques, and specific offers at the popular mobiles.

Tags: Apps, E commerce, India, net, online Wallets, Paytm, Vijay Shekhar Sharma