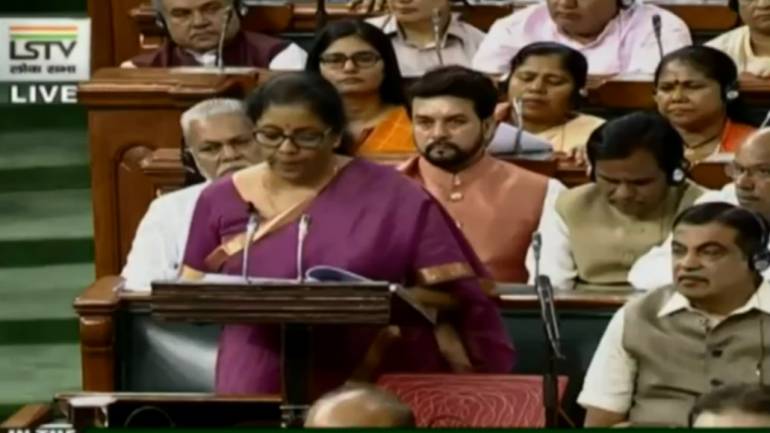

The Finance (No. 2) Bill, 2019 was passed in the 17th Lok Sabha on July 18.

Finance Minister Sitharaman said that the tax proposals in the Finance Bill 2019 are aimed at improving the ease of living and reducing pain of the citizens.

While replying to discussion on the Finance Bill, Sitharaman said Budget proposals will promote Make in India and digital payment.

The Minister, however, did not relax the tax proposals with regards to Foreign Portfolio Investors, TDS on cash withdrawal above Rs 1 crore from banks and hike in customs duty on newsprint as was being demanded by the Opposition.

Referring to the imposition of 1 percent TDS on cash withdrawal beyond Rs 1 crore, she said the tax could be adjusted against the liability of the assesses and hence there will be no additional burden on them.

On the proposal to hike tax liability on individuals earning more than Rs 2 crore, she said it will not impact FPIs provided they organised themselves as a company.

With regard to simplification of tax laws, the Ministry has already set up a task force to finalise a new Direct Tax Code (DTC), she said.

The Finance Minister, however, did not say anything on the proposal

to increase customs duty to 10 percent on newsprint.

Several members have asked the government to reduce the hike

in customs duty on newsprint saying it would badly hurt the

small and medium newspapers.

[“source=moneycontrol”]