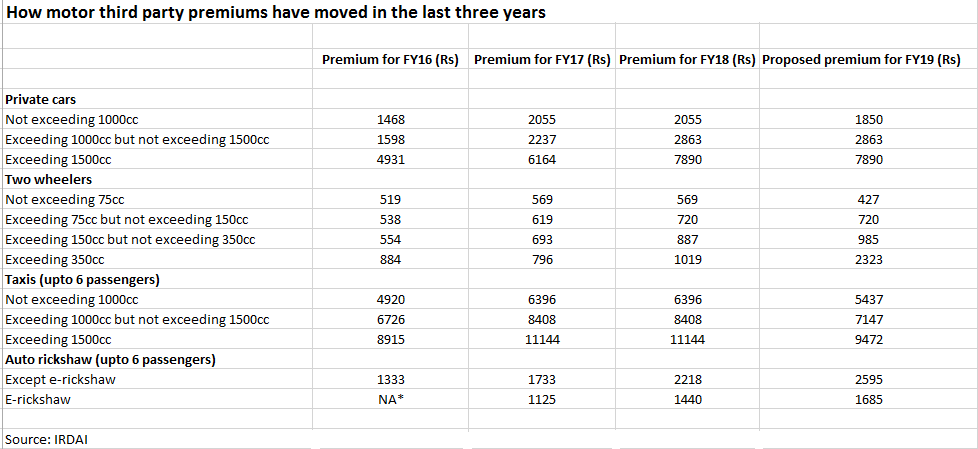

There is good news for car and two-wheeler owners. Insurance Regulatory and Development Authority of India (IRDAI) has proposed to reduce third party (TP) premiums for FY19 in certain segments starting April 1.

After the revision TP premiums for cars less than 1000cc and two-wheelers under 75cc will come down by 10 percent and 25 percent, respectively.

In several categories (as per engine capacity), the premiums have been left unchanged.

In two categories of two-wheelers though, the premium has been increased as per the IRDAI draft. As a result, in 150-350cc engine category, popular bikes like Royal Enfield’s Classic 350 and Thunderbird 350 may see premiums going up by 11 percent.

For bikes above 350cc which includes several large bikes and superbikes from brands such as KTM, Royal Enfield and Harley Davidson, premiums will go up by more than Rs 1,000.

Third party motor insurance is mandatory for all vehicles running on Indian roads. However, the premium is regulated by IRDAI and revised annually based on the claims experience of each insurer with data given by the Insurance Information Bureau of India (IIB).

Usually, it is the commercial vehicles like large trucks and goods-carrying vehicles which are most accident prone due to riding in tough conditions and size.

Even in FY19 too, IRDAI has proposed an increase between 4-30 percent in certain categories of goods vehicles both public as well as private carriers.

Every year, IRDAI brings out an exposure draft to revise premiums in the beginning of March. Based on the response of stakeholders, the final premiums are decided.

Motor TP refers to premiums paid against any third party liability that the owner faces if his vehicle is involved in an accident that causes death/disability to another vehicle’s passengers or pedestrians.

The emphasis is to not lead to heavy premium increase for customers on one hand while allowing insurers to write business at sustainable rates. Transport lobbies call for lower premiums every year while insurers usually seek a hike in large commercial motor businesses.

An interesting segment is the vintage care space where the regulator, since 2017, has been aiming to incentivise owners of such vehicles. IRDAI said that with respect to vintage cars segment, there is no substantial data of past experience. Therefore, a discounted price of50 percent of the proposed rate based on the erstwhile Indian Motor tariff (IMT) is proposed, for those private cars certified as Vintage cars by Vintage & Classic Car club of India.

Motor third party has been a loss-making business for general insurance companies, since the claims they pay are more than the premiums collected annually. To bridge this gap, insurers seek a rise in premium of 10-30 percent every year in segments with large claims.

Unlike other insurance products, there is no limit on the amount that can be claimed under motor TP products. Also, there has been also an increase in the compensation provided to victim by consumer forums, which the insurer is required to pay.

[“Source-moneycontrol”]