It’s really great to see that even after a strong run, Indiabulls Real Estate (NSE:IBREALEST) shares have been powering on, with a gain of 69% in the last thirty days. The full year gain of 21% is pretty reasonable, too.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

Does Indiabulls Real Estate Have A Relatively High Or Low P/E For Its Industry?

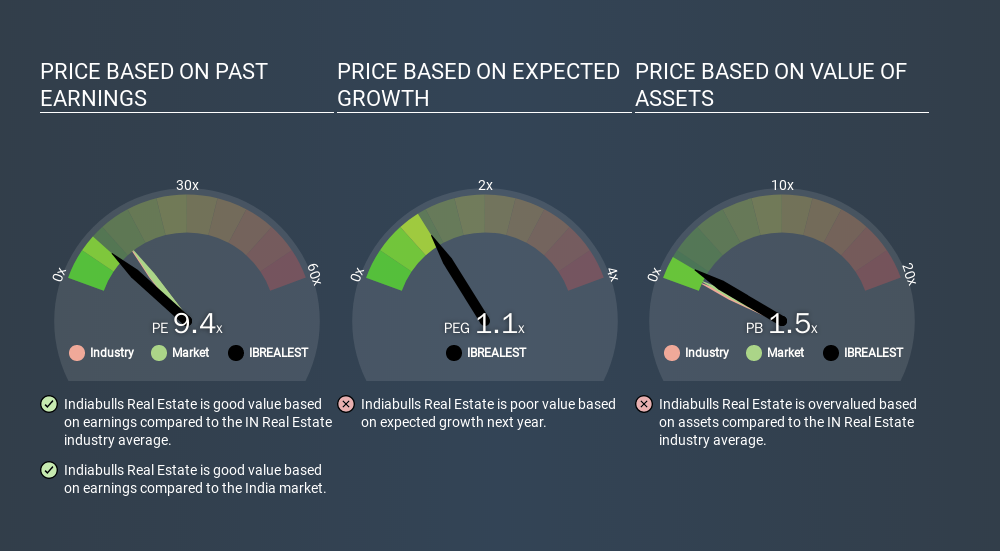

We can tell from its P/E ratio of 9.44 that sentiment around Indiabulls Real Estate isn’t particularly high. The image below shows that Indiabulls Real Estate has a lower P/E than the average (13.8) P/E for companies in the real estate industry.

Indiabulls Real Estate’s P/E tells us that market participants think it will not fare as well as its peers in the same industry. Many investors like to buy stocks when the market is pessimistic about their prospects. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. Earnings growth means that in the future the ‘E’ will be higher. That means unless the share price increases, the P/E will reduce in a few years. A lower P/E should indicate the stock is cheap relative to others — and that may attract buyers.

Indiabulls Real Estate saw earnings per share decrease by 75% last year. But EPS is up 26% over the last 5 years.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

Don’t forget that the P/E ratio considers market capitalization. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Indiabulls Real Estate’s Balance Sheet

Indiabulls Real Estate’s net debt equates to 34% of its market capitalization. While it’s worth keeping this in mind, it isn’t a worry.

The Verdict On Indiabulls Real Estate’s P/E Ratio

Indiabulls Real Estate’s P/E is 9.4 which is below average (14.0) in the IN market. With only modest debt, it’s likely the lack of EPS growth at least partially explains the pessimism implied by the P/E ratio. What we know for sure is that investors are becoming less uncomfortable about Indiabulls Real Estate’s prospects, since they have pushed its P/E ratio from 5.6 to 9.4 over the last month. If you like to buy stocks that could be turnaround opportunities, then this one might be a candidate; but if you’re more sensitive to price, then you may feel the opportunity has passed.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, ‘In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

You might be able to find a better buy than Indiabulls Real Estate. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

[“source=simplywall”]